1031 Exchange Timeline Explained (45-Day Rule + 180-Day Close)

Quick Summary: The IRS allows you to defer capital gains tax on real estate by using a 1031 Exchange. But if you miss either the 45-day identification or 180-day closing deadline, you’ll owe the full tax. Let’s break down the timeline and help you defer smarter with our free calculator.

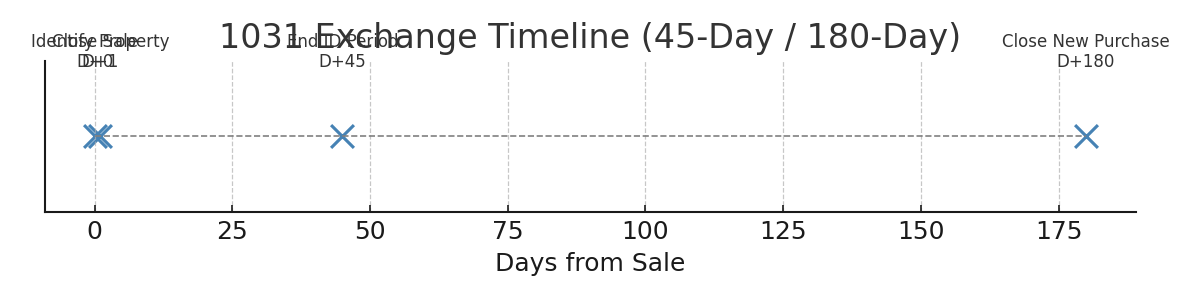

📅 Visual: 1031 Exchange Timeline

| Step | Description | Deadline |

|---|---|---|

| 1 | Close Sale of Original Property | Day 0 |

| 2 | Identify Replacement Property | By Day 45 |

| 3 | Finalize Identification | Day 45 |

| 4 | Close Purchase of New Property | By Day 180 |

📥 Download: 1031 Tax Deferral Calculator (.xlsx)

📥 1031 Exchange Capital Gains Calculator✅ 1031 Exchange Rules (What the IRS Requires)

- Like-Kind Property: Must be real estate for real estate, regardless of type.

- Qualified Intermediary (QI): Required to hold proceeds — you cannot take possession.

- Contract Clause: Include 1031 exchange language in sale and purchase contracts.

- Deadlines: Both 45-day and 180-day periods are calendar days from the closing date.

🔁 Reverse 1031 vs Standard Exchange

- Standard: Sell first, then buy new property within 180 days.

- Reverse: Buy first, then sell — more complex, requires escrow and QI early.

🧠 Pro Tips

- Use a spreadsheet to track deadlines and set calendar reminders.

- Always verify your 1031 eligibility with a CPA before closing.

- Consider a backup ID in case one deal falls through.

👉 Related Articles

Disclaimer: This article is for informational purposes only and does not constitute tax or legal advice. Consult a qualified intermediary or tax advisor.